Discover the latest IRS guidance on the SECURE 2.0 Act of 2022. Get clarity on matching qualified student loan payments (QSLP), automated features, using financial incentives, and treating certain funds as Roth contributions.

The IRS has issued additional regulatory clarity on certain provisions of the SECURE 2.0 Act of 2022 (SECURE 2.0). provides specific guidance on employer matching contributions for student loan repayments. , contains much-needed guidance to a variety of provisions.

The new information covers both required and optional provisions effective now and, in the future. Below youÔÇÖll find some of the more impactful guidance for those provisions currently in effect.

How do matching contributions on qualified student loan payments (QSLP) work? (Section 110)

Student loan obligations can often prevent or delay employees from saving for retirement and miss out on employer matching contributions.

Not participatingÔÇöpaying off student loan debt

51│ď╣¤║┌┴¤┬« Retirement Security SurveyÔÇöNonparticipants (December 2023)

SECURE 2.0 now allows employers to treat qualified student loan payments (QSLP) made by employees as elective deferrals for the purpose of making matching contributions to the employees retirement account. The matching student loan payment is an optional provision that became effective as of January 1, 2024, to retirement plans already offering matching employer contributions.

Below are highlights from the most recent IRS update. For more comprehensive guidance, see .

- A QSLP is a payment made by an employee during a retirement plan year in repayment of a qualified student loan taken out by the employee, the employeeÔÇÖs spouse, or the employee's dependent.

- QSLP matching contributions canÔÇÖt be restricted to only the employeeÔÇÖs own education, a particular degree program, or attendance at a particular school.

- Only the individual who makes the loan payments can receive a QSLP match on account of those payments. A co-signor could only receive a QSLP match if the co-signor makes payments themselves.

- The employee is responsible for certifying their loan payments are qualified.

- Employers may establish their own reasonable procedures to implement QSLP matching contributions. This includes setting deadlines for claiming the match and the schedule for calculating the matching contributions.

- The schedule for calculating the QSLP matching contributions can be different from when elective deferral matching contributions are calculated.

Is your retirement plan required to have automatic enrollment and automatic escalation? (Section 101)

To get more employees to participate and save enough in their employerÔÇÖs retirement plan, SECURE 2.0 requires that new 401(k) and 403(b) plans utilize a minimum threshold of auto-enrollment and auto- escalation. This change should help drive significant benefits for retirement savers covered by newly established plans. Both proprietary data and survey results show that most employees would stay in the plan if automatically enrolled. Thus, creating a scenario meant to help individuals be better prepared for retirement.

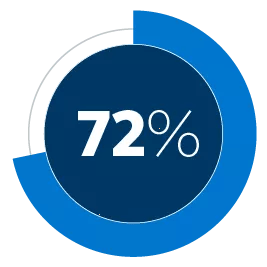

Of participants would continue contributing to the retirement plan if automatically enrolled.

51│ď╣¤║┌┴¤┬« Retirement Security Survey ÔÇô Eligible but not participating, December 2023.

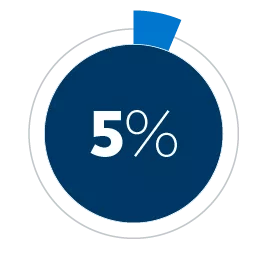

Of participants opt out automatic enrollment, no matter the default deferral rate.

51│ď╣¤║┌┴¤┬« proprietary data as of Oct. 31, 2023.

What are the SECURE 2.0 rules for financial incentives to promote retirement plan participation? (Section 113)

Though we believe incorporating automatic enrollment and automatic escalation are the primary plan design features to increase participation, incentives can be an additional option.

SECURE 2.0 allows plan sponsors to offer small financial incentives to employees to help boost plan participation.

IRS Notice 2024-2 clarifies that the incentive:

- Can only be made to employees without an election to defer on file.

- Cannot exceed $250 in value.

- Cannot be made as a matching contribution nor be paid from plan assets.

- May be offered as a lump sum or as a series of installments, even over multiple plan years. For example, a plan sponsor may offer a $150 cash card for employees who enroll within the next 30 days and an additional $100 if the employee is still enrolled one year later. Incentive amounts are includable in an employeeÔÇÖs gross income and wages and are subject to withholding and reporting requirements unless another exception applies.

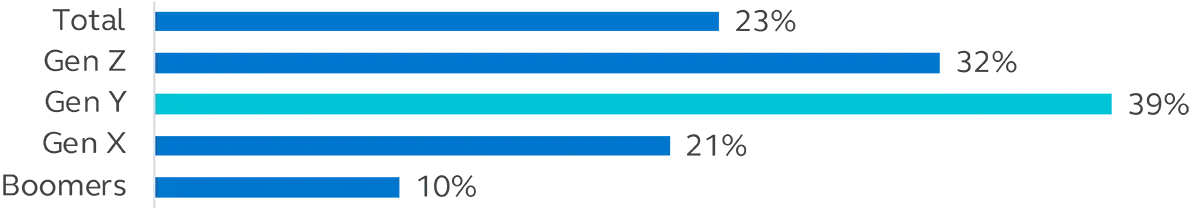

The ability to use incentives may encourage those who are less likely to contribute to the retirement plan. Our data shows that age and income influence oneÔÇÖs decision to participate. Gen Z and those making less than $50,000 annually are most likely not to participate in the employer-sponsored retirement plan.

Can employer matching or nonelective contributions be treated as Roth contributions? (Section 604)

Today, most plan sponsors (76%) offer employees the option to designate their deferral as Roth contributions.

SECURE 2.0 provides 401(k), 403(b), and governmental 457(b) plan sponsors the option of permitting employees who are fully vested in their employer contributions to designate employer and nonelective contributions as Roth contributions.

The new guidance clarifies that Roth employer and nonelective contributions are not subject to withholding (employees choosing this option may want to increase their withholding as a result) and are not treated as wages for purposes of FICA tax and FUTA tax, with one exception:

Roth nonelective contributions to a governmental 457(b) plan may be subject to FICA, but only if FICA taxes would otherwise apply to the employees.

Roth employer and nonelective options are includable as gross income for the taxable year in which the contribution is allocated to the account and must be reported on Form 1099-R.

Though this optional provision was available as of 2023, retirement plan service providers were waiting for clarification about the taxes. They can now determine the type of build-out capabilities needed to support their systems.

WhatÔÇÖs next for Secure 2.0?

We expect the IRS to issue additional guidance throughout the year on provisions in which there are still outstanding questions. In the meantime, find answers to trending questions about the SECURE 2.0 Act and what it means for employers.