Designing a retirement plan that helps all health care workers save for retirement can be challenging. Using ownership structure and tax status, Marc Howell presents plan designs to help participants save more, pass nondiscrimination testing, and watch the bottom line.

The challenges health care organizations face when providing a retirement plan to fit the needs of all their employees can be complex. No matter their size, ownership structure, or tax status (for-profit or not-for profit), many could use the knowledge and insights provided through enhanced retirement plan design . This information could help recruit and retain these in-demand employees, help provide a path to retirement security for the vast array of workers and manage costs to possibly improve the organizationÔÇÖs bottom line.

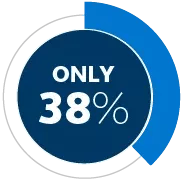

How health care workers feel about saving for retirement:

ARE COMFORTABLE

with the retirement planning process

WORRY THEY'RE NOT SAVING

enough for retirement

ARE COMFORTABLE

they'll reach retirement financial goals

The health care industry and retirement plans

Plan design is a vital component to help drive retirement success for employees, and we see it as especially true for health care organizations. However, for health care, we need to dig deeper. There can be a large spread in compensation earned among health care workers, which can make plan compliance nondiscrimination testing difficult to pass.

Source: American Hospital Association. Fast Facts on U.S. Hospitals, 2023

These wage disparities not only exist across job titles (CNAs vs. doctors for example), but also within the same job title. WeÔÇÖve seen companies with CNAs who break into highly compensated employee status due to the amount of overtime they work. And nurses can fall into a variety of categories, each with variable pay depending on hours worked, location, and the availability of enhanced pay programs. Not to mention that much of health care is not-for-profit and some partner owned, both of which can make things even more challenging when designing the retirement plan.

Designing retirement plans for health care workers:

of U.S. hospitals are not-for-profit

Constructing a retirement plan for a health care organization that meets the needs of its workers and passes nondiscrimination testing is possible. The primary piece of business to understand is the health care providerÔÇÖs tax status and ownership structure. Whether not-for-profit or for-profit, partner owned or not, each have intricacies that can impact the success of a retirement plan. Knowing the structure opens the door to the different types of plans that may work to help both highly compensated employees (HCE) and non-HCEs save for retirement, while passing plan compliance testing.

Retirement plans: Not-for-profit health care organizations

of U.S. hospitals are for-profit

When you have a workforce with highly variable compensation, often in a quasi-governmental or not-for-profit structure, not only are qualified plans often restricted, but so are nonqualified plans. Many qualified plan designs may emphasize discretionary or non-elective contributions in addition to or over employer match structures. These types of features can sometimes unintentionally suppress participation rates, which can apply pressure to non-discrimination testing results. At the same time, many HCEs, particularly non managerial physicians, may be significantly limited in their ability to save within nonqualified plans, and this needs to be carefully understood and managed.

Retirement plans: For-profit health care organizations that are not partner owned

Typically, these types of for-profit health care organizations may be less likely to have the discretionary or non-elective contributions we see in not-for-profit. Margins can be tight, creating stress on the retirement benefits, even while the organization is competing for talent across health care organizations of all types.

Nonqualified deferred compensation (NQDC) plans. Allows a select group of key and highly compensated employees the opportunity to defer additional pre-tax compensation over and above the annual IRS limits of a 401(k) plan. These are usually less restrictive than we find on the not-for-profit side, but restrictions can still certainly apply and should be understood.

Safe harbor plans. Safe harbor 401(k) plans typically allow HCEs to save up to the annual IRS contribution limit and not fail nondiscrimination testing. Given the additional testing requirements on 401(k) vs 403(b) programs, safe harbor designs may be more attractive in this market.

Custom designed defined contribution plans. As described above, but these creative plans are designed specifically for non-partner owned, for-profit health care organizations.

Retirement plans: For-profit health care organizations that are partner owned

Partnership ownership structures can create a lot of complexity, but also significant opportunity for well-designed plans to help make a difference. The decision process for these plans considers not only cost to the organization and benefits for the employees, but also the tax implications and benefits the partnership accrues. These plans require significant contributions to non-owners as well, which can create upward pressure in the marketplace on benefits. For a nurse, CNA, receptionist, or other health care worker, the retirement benefits provided by a private practice can be significantly larger than what other non-partner owned organizations may want to provide.

New comparability profit-sharing plan. Also known as a cross-tested or tiered profit-sharing plan, it can be used when there are key employees making significantly more than others to maximize their contributions. Such a plan divides employees into two or more groups based on objective standards such as job title or position. It then allows the employer to target one group of employees with a greater percentage of profit-sharing contributions versus the other. Generally new comparability plans are meant to try to maximize retirement contributions for partners within the defined contribution structure.

Cash balance plan. Employees have their own account, to which only the employer makes contributions; employees cannot defer into this plan. Participants are then promised a monthly benefit stream at retirement. However, with a cash balance plan, itÔÇÖs optional for the employee to take a lump sum instead. Sometimes these plans are built to quickly accumulate significant retirement assets for the partners, and other times they may be built to ÔÇťpre-fundÔÇŁ anticipated buyouts of partners as people approach retirement. These types of plans can create opportunities to defer annual amounts for partners significantly above even a well-designed new comparability program, but there are pros and cons to both.

Collaborate with a health care retirement professional.

Health care is an intricate business, and supporting retirement plans for health care organizations and their wide range of workers can be equally challenging, but it is possible. The interaction of the various types of health care organizations as laid out above, their goals, and the pressures they face can create dynamic markets for retirement benefits. Properly benchmarking and understanding the competitive situation an organization faces can be a great first step to understanding what the organization may need to provide to properly recruit and retain the talent they need. The above ideas are just the beginning.

What's next?

ItÔÇÖs important to work with a retirement service provider that understands and has the expertise to consult on options to help deliver the desired results. If youÔÇÖre looking for options that could work in building a more robust retirement planÔÇöreach out to your 51│ď╣¤║┌┴¤┬« representative for an enhanced plan design consultation.