It鈥檚 never too early to start planning for retirement鈥攂ut many people wait until it鈥檚 almost too late. While almost 40% of adults start putting away money for retirement in their 20s,1 54% of people didn鈥檛 even begin creating a retirement plan until they were in their 50s.2

It鈥檚 never really too late, though, to figure out how to plan for retirement. These five steps can help.

1. Establish a goal of how much money you may need in retirement.

A goal may not mean an exact dollar figure. Instead, think of this as a rough idea of how much income you may need in retirement.

If you haven鈥檛 tackled that before, a resource like the may be a good place to start. It uses current age, income, and retirement contributions, as well as past savings, estimated Social Security benefit, and goal retirement age to give you an idea of how much you may need, and how you鈥檙e progressing toward that goal.

2. Save as much as you can, for as long as you can.

The earlier you start saving鈥攅ven if you鈥檙e not sure of your exact retirement goals鈥攖he more you鈥檒l gain from financial concepts like compound interest.

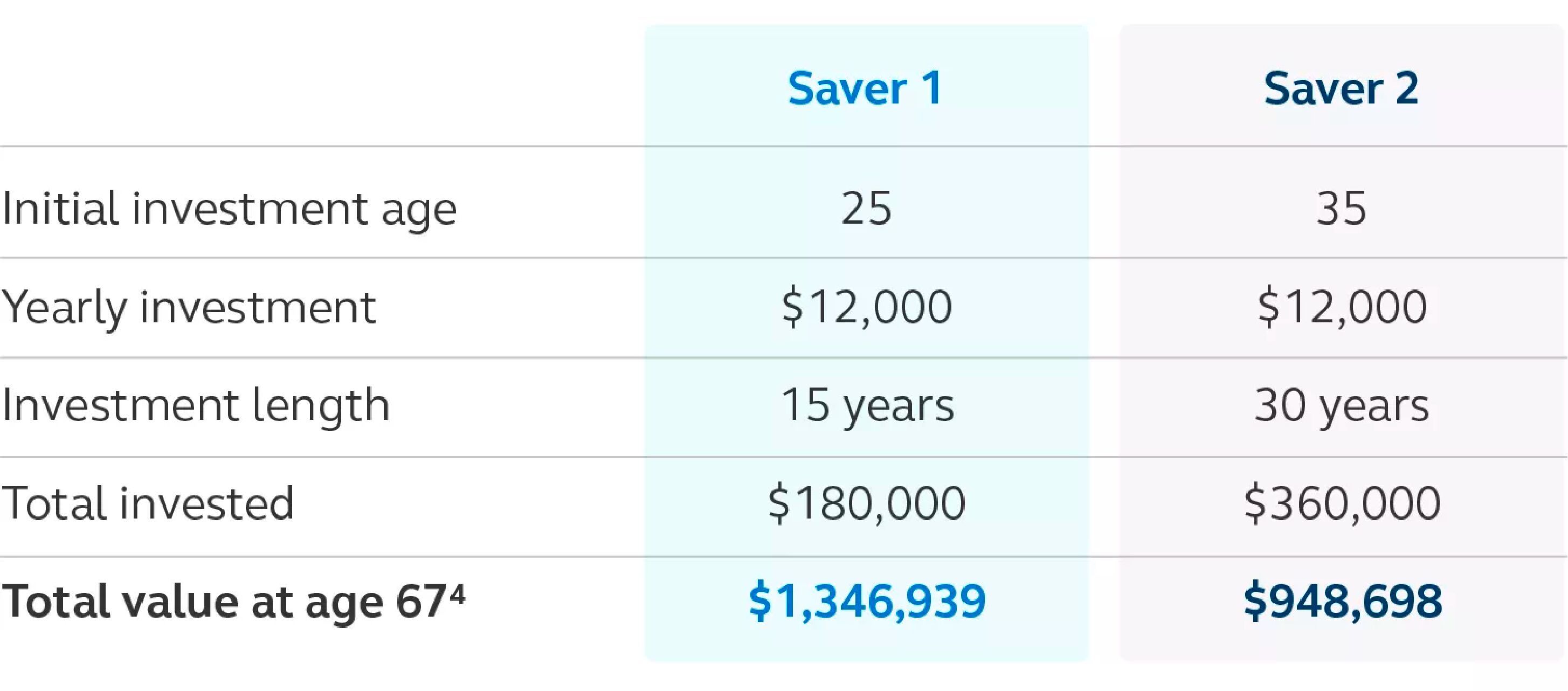

For example, imagine this scenario: You start saving in your mid-20s for just 15 years, or you start saving at age 35 and stash money away for 30 years. You鈥檇 have more in the latter scenario than the former, right? Surprisingly, no.3

Saving sooner鈥攂ut for less time鈥攇ives you a greater advantage.

3. Include Social Security as part, but not all, of your retirement plan.

Social Security was never intended as a full income replacement program; instead, it鈥檚 supposed to replace just a portion of your pre-retirement income and work with other retirement savings.

How much Social Security figures into your retirement planning depends on your lifetime earnings and the age at which you claim benefits. (Currently, you鈥檒l reap the biggest financial benefit by waiting until age 70.) What form Social Security may take when you retire depends a lot on future benefit levels and legislative support, to name just two factors.

You can track more about your forecasted potential benefits by .

4. Adjust your retirement savings plan to make up for lost ground.

Life is complicated, and financial goals change from year to year. If there have been times you haven鈥檛 been able to put away as much as you wanted for retirement, you have options to make up the gap so you can still meet your goals. Those include:

- Increase your contribution in a workplace-sponsored retirement plan like a 401(k). Think an extra 1% a year, or at least enough to get the company match.

- Set up an individual retirement account (IRA) or Roth IRA to save in addition to any workplace plans if income and contribution limits allow.

- Make catch-up contributions to your 401(k) (if your plan allows) or IRA if you鈥檙e 50 or older.

- Pay off debt, then stash those funds in retirement savings.

- Extend your retirement date, even by a year or two.

5. Check in on your retirement plan at least once a year.

You probably reassess your monthly budget yearly (or more frequently). Your retirement savings deserve the same attention, even if you're just making sure your address and beneficiaries are up to date. That check-in also gives you an opportunity to consolidate older retirement accounts into an individual retirement account.

Next steps

to see if your savings rate matches your current retirement plan goals. Don鈥檛 have an employer-sponsored retirement account or want to save even more? We can help you set up your retirement savings with an IRA or Roth IRA account. Ready to learn more ways you can build your financial foundation? Our learning library can help.